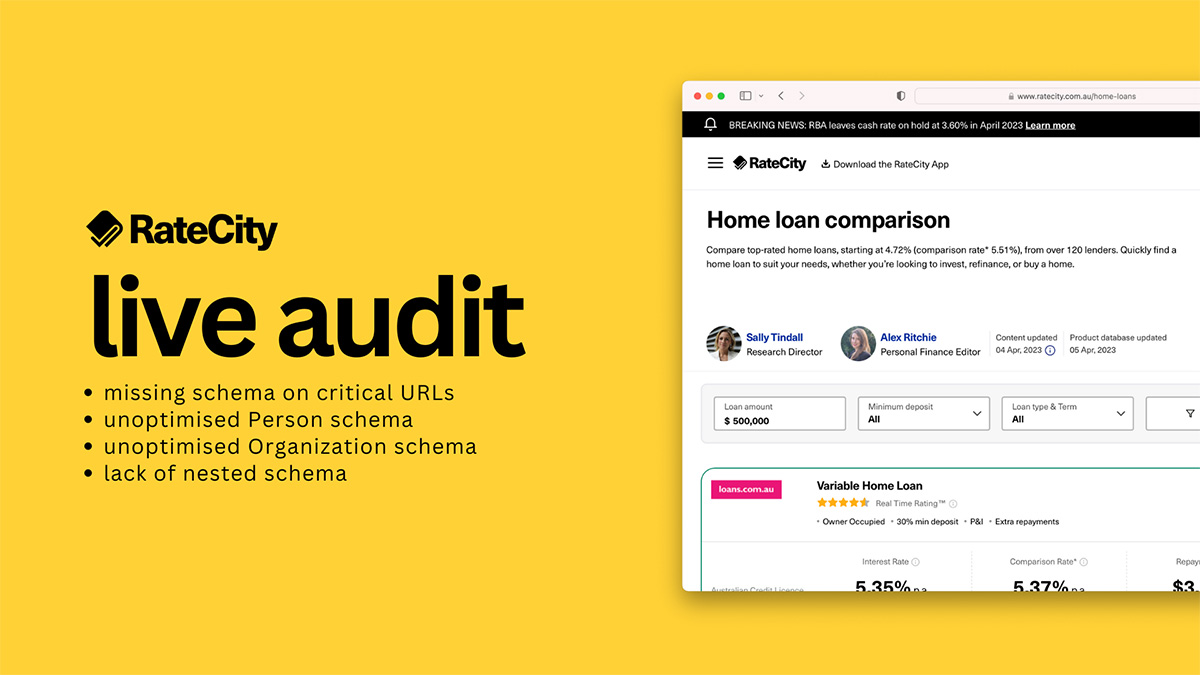

RateCity.com.au – Mistakes were made

RateCity.com.au is a well-known Australian brand in the YMYL space with Sally Tindall being a frequent on News segments on topics such as property and interest rates.

It’s Home loan comparison page ranks in the top 3 for many competitive keywords.

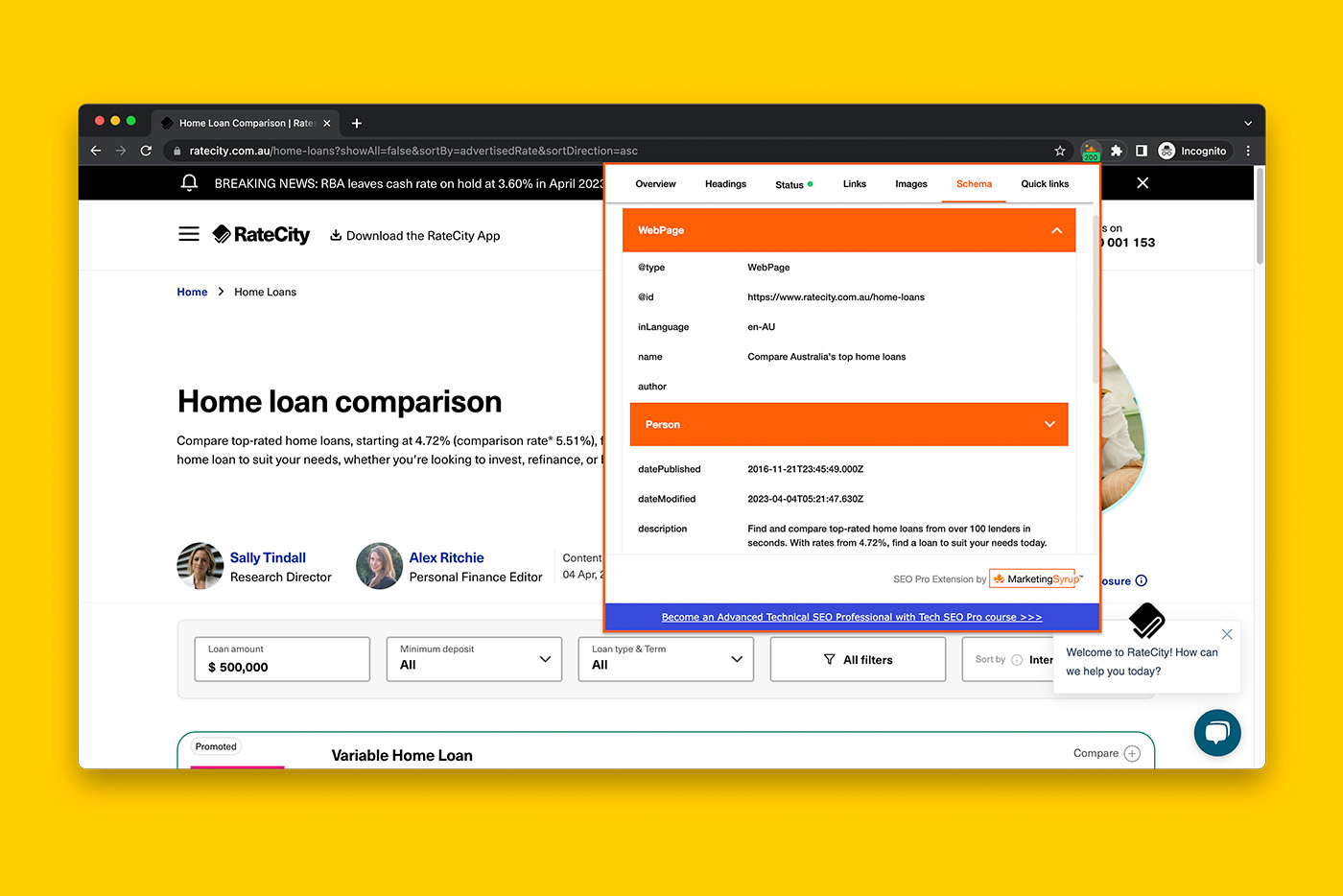

And at first glance, there is some schema markup on the URL (see below).

Similarly, when the URL is put into schema.org’s validator, it was evident the structured data markup could be improved significant.

In this video, I perform a live schema audit of one of their most highly visible pages – their home loan comparison page.

For your reference, here is the JSON-LD from the video.

<script type="application/ld+json">

{

"@context":"https://schema.org",

"@graph":[

{

"@type":"Dataset",

"name":"Home Loan Comparison | Rates from 4.72% | RateCity",

"url":"https://www.ratecity.com.au/home-loans",

"@id":"https://www.ratecity.com.au/home-loans#dataset",

"description":"Compare top-rated home loans, starting at 4.72% (comparison rate%ComparisonTooltip% 5.51%), from over 120 lenders. Quickly find a home loan to suit your needs, whether you're looking to invest, refinance, or buy a home.",

"datePublished":"2016-11-21T23:45:49+00:00",

"inLanguage":"en-AU",

"variableMeasured":"home-loans",

"isAccessibleForFree":"https://schema.org/True",

"spatialCoverage":{

"@type":"Place",

"name":"Australia"

},

"creator":{"@id":"https://www.ratecity.com.au#organization"},

"isPartOf":{"@id":"https://www.ratecity.com.au/home-loans#webpage"}

},

{

"@type":"WebPage",

"@id":"https://www.ratecity.com.au/home-loans#webpage",

"url":"https://www.ratecity.com.au/home-loans",

"name":"Compare Australia's top home loans",

"datePublished":"2016-11-21T23:45:49+00:00",

"dateModified":"2023-04-04T05:21:47+00:00",

"lastReviewed":"2023-04-04T05:21:45+00:00",

"speakable":"Find and compare top-rated home loans from over 100 lenders in seconds. With rates from 4.72%, find a loan to suit your needs today.",

"keywords":["home loans","home loan comparison"],

"isPartOf":{

"@type":"WebSite",

"url":"https://www.ratecity.com.au",

"@id":"https://www.ratecity.com.au#website"

},

"author":[

{"@id":"https://www.ratecity.com.au/author/sally-tindall#person"},

{"@id":"https://www.ratecity.com.au/author/alex-ritchie#person"}

],

"reviewedBy":{"@id":"https://www.ratecity.com.au/author/mark-bristow#person"}

},

{

"@type":"FAQPage",

"@id":"https://www.ratecity.com.au/home-loans#faq",

"isPartOf":{

"@type":"WebPage",

"@id":"https://www.ratecity.com.au/home-loans#webpage"

},

"mainEntity": [{

"@type": "Question",

"name": "What is Lender’s Mortgage Insurance (LMI)?",

"acceptedAnswer": {

"@type": "Answer",

"text": "<p>Lender’s Mortgage Insurance (LMI) is an insurance policy, which protects your bank if you default on the loan (i.e. stop paying your loan). While the bank takes out the policy, you pay the premium. Generally you can ‘capitalise’ the premium – meaning that instead of paying it upfront in one hit, you roll it into the total amount you owe, and it becomes part of your regular <a href='http://www.ratecity.com.au/home-loans/calculator'>mortgage repayments</a>.</p><p>This additional cost is typically required when you have less than 20 per cent savings, or a loan with an LVR of 80 per cent or higher, and it can run into thousands of dollars. The policy is not transferrable, so if you sell and buy a new house with less than 20 per cent equity, then you’ll be required to foot the bill again, even if you borrow with the same lender.</p><p>Some lenders, such as the <a href='http://www.ratecity.com.au/companies/commonwealth-bank'>Commonwealth Bank</a>, charge customers with a small deposit a Low Deposit Premium or LDP instead of LMI. The cost of the premium is included in your loan so you pay it off over time.</p>"

}

},{

"@type": "Question",

"name": "How much deposit will I need to buy a house?",

"acceptedAnswer": {

"@type": "Answer",

"text": "<p>A deposit of 20 per cent or more is ideal as it’s typically the amount a lender sees as ‘safe’. Being a safe borrower is a good position to be in as you’ll have a range of lenders to pick from, with some likely to offer up a lower interest rate as a reward. Additionally, a deposit of over 20 per cent usually eliminates the need for lender’s mortgage insurance (LMI) which can add thousands to the cost of buying your home.</p><p>While you can get a loan with as little as 5 per cent deposit, it’s definitely not the most advisable way to enter the home loan market. Banks view people with low deposits as ‘high risk’ and often charge higher interest rates as a precaution. The smaller your deposit, the more you’ll also have to pay in LMI as it works on a sliding scale dependent on your deposit size.</p>"

}

},{

"@type": "Question",

"name": "What is the difference between fixed, variable and split rates?",

"acceptedAnswer": {

"@type": "Answer",

"text": "Fixed rate

A fixed rate home loan is a loan where the interest rate is set for a certain amount of time, usually between one and 15 years. The advantage of a fixed rate is that you know exactly how much your repayments will be for the duration of the fixed term. There are some disadvantages to fixing that you need to be aware of. Some products won’t let you make extra repayments, or offer tools such as an offset account to help you reduce your interest, while others will charge a significant break fee if you decide to terminate the loan before the fixed period finishes.

Variable rate

A variable rate home loan is one where the interest rate can and will change over the course of your loan. The rate is determined by your lender, not the Reserve Bank of Australia, so while the cash rate might go down, your bank may decide not to follow suit, although they do broadly follow market conditions. One of the upsides of variable rates is that they are typically more flexible than their fixed rate counterparts which means that a lot of these products will let you make extra repayments and offer features such as offset accounts.

Split rates home loans

A split loan lets you fix a portion of your loan, and leave the remainder on a variable rate so you get a bet each way on fixed and variable rates. A split loan is a good option for someone who wants the peace of mind that regular repayments can provide but still wants to retain some of the additional features variable loans typically provide such as an offset account. Of course, with most things in life, split loans are still a trade-off. If the variable rate goes down, for example, the lower interest rates will only apply to the section that you didn’t fix."

}

},{

"@type": "Question",

"name": "What is a loan-to-value ratio (LVR)?",

"acceptedAnswer": {

"@type": "Answer",

"text": "A loan-to-value ratio (otherwise known as a Loan to Valuation Ratio or LVR), is a calculation lenders make to work out the value of your loan versus the value of your property, expressed as a percentage. Lenders use this calculation to help assess your suitability for a home loan, and whether you need to pay lender’s mortgage insurance (LMI). As a general rule, most banks will require you to pay LMI if your loan-to-value ratio is 80 per cent or more. LVR is worked out by dividing the loan amount by the value of the property. If you are looking for a quick ball-park estimate of LVR, the size of your deposit is a good indicator as it is directly proportionate to your LVR. For instance, a loan with an LVR of 80 per cent requires a deposit of 20 per cent, while a 90 per cent LVR requires 10 per cent down payment.

LOAN AMOUNT / PROPERTY VALUE = LVR%

While this all sounds simple enough, it is worth doing a more accurate calculation of LVR before you commit to buying a place as there are some traps to be aware of. Firstly, the ‘loan amount’ is the price you paid for the property plus additional costs such as stamp duty and legal fees, minus your deposit amount. Secondly, the ‘property value’ is determined by your lender’s valuation of the property, not the price you paid for it, and sometimes these can differ so where possible, try and get your bank to evaluate the property before you put in an offer."

}

},{

"@type": "Question",

"name": "What is a comparison rate?",

"acceptedAnswer": {

"@type": "Answer",

"text": "The comparison rate is known as the ‘real’ interest rate you have to pay – unlike the advertised interest rate, which is often an artificially low number. That’s because the comparison rate includes both the advertised rate and the associated fees. According to the industry standard, comparison rate calculations are made on the assumption that the car loan will be for $30,000 over five years."

}

}]

}

]

}

</script>Did you enjoy this content?

Did you learn something new about semantic SEO?

Then make sure you subscribe to Scheming Schemas – a YouTube channel dedicated at showing the behind-the-scenes of semantic search.